Blank Atm Card Post Comment and Review @facebookcom

Monese was among the very first banks in the Great britain to only exist available via a mobile app. The bank'due south founder opened the depository financial institution due to his disability to open a bank account in the UK because he did not have local utility bills or a credit history. Noticing that he was not the merely i with the trouble, The Monese Banking concern and App was born.

Visit Monese or Get Monese App (Android or iOS)

A Brief History of Monese

Contents

- i A Brief History of Monese

- ii Easy & Accessible UK Bank Account

- 3 Monese Regulations

- 4 Why Is Monese Necessary?

- 5 Opening an Account with Monese – What Do You lot Demand?

- 6 What Types of Accounts Does Monese Offer?

- 7 Simple – £0/month

- 8 Classic – £5.95/month

- ix Premium – £14.95/month

- ten Main Features of an Account with Monese

- 11 Monese Fees

- 12 Monese Debit Bill of fare

- 13 Apple tree Pay

- xiv How Do Yous Lock Your Monese Carte?

- fifteen How Practice Yous Make Deposits to Your Monese Account?

- xvi Withdrawal Fees from Monese

- 17 How Can Y'all Make Payments with Monese?

- eighteen International Money Transfers with Monese

- 19 Help with Budgeting

- 20 What Types of Notifications Does Monese Provide?

- 21 Monese & Avios Partnership

- 22 Monese Security

- 23 Conclusion

- 24 Monese

- 24.1 Ease of Use

- 24.2 Fees

- 24.iii Reputation

- 24.4 Customer Support

- 24.five Design

- 25 Pros

- 26 Cons

In 2014, Monese founder Norris Koppel moved from Estonia to the Great britain. He had no utility bills to testify his address and no Britain credit history. This meant that Koppel found it impossible to open up a depository financial institution account. Without a depository financial institution account, Koppel could non rent an apartment or receive his salary.

- Koppel launched Monese in September 2015, so others would not accept to experience the same struggles.

- Monese was designed equally a banking service that is on-demand, instant, and inclusive.

- When Monese launched, it was the very first 100 per cent mobile current business relationship in the United Kingdom.

- At present, it is possible for those beyond Europe to open a current Britain account in a matter of minutes.

- Monese likewise avoids the restrictions and subconscious fees common of legacy banks.

Monese was a success from the commencement, and it earned the 2016 European Fintech Awards' All-time Challenger-Banking concern honour. By 2017, the client transactions on Monese were more than than one-half a billion pounds.

Easy & Accessible United kingdom Bank Account

Monese continues to remain true to its roots, offer a electric current UK account that is simple to open. It is attainable for everyone, regardless of whether they have documentation for utility bills or perfect credit scores.

Monese also now offers both GBP and EUR accounts – useful for keeping dual accounts for spending money abroad or hedging confronting the pound dropping.

So far, Monese has opened tens of thousands of on-demand accounts that are mobile-simply for customers across the Uk and EU. Monese even received €ane.1 million from the European Commission to use for innovation and research.

Monese Regulations

Monese is fully registered with the Financial Conduct Authority of the UK for 100 per cent security.

Monese is a registered agent for PrePay Technologies Limited, an electronic money establishment that the FCA authorises post-obit the Electronic Money Regulations 2011 (900010) to issue electronic money and payment instruments.

Why Is Monese Necessary?

Monese offers an alternative to the shortcomings that come with traditional banks. Most banks in the UK require a credit history, utility bills, and plenty of fees. By dissimilarity, Monese accepts near every single client that applies for an account. There is no demand to have a regular stock-still income, a credit history, or even be established in the country.

Opening an Account with Monese – What Practise You Need?

As mentioned, Monese was designed to get in simple to open an business relationship. To open an account with Monese, you must live within the European Economic Surface area (EEA), although the bank is constantly expanding its reach to appeal to more than customers.

To open an account with Monese, y'all do not need to provide any proof of address. In that location is also no need to visit a branch in person or have a good credit history.

When yous are set up to open a United kingdom of great britain and northern ireland current account, y'all only download the mobile application and so follow the on-screen step-by-step instructions to open and then verify the account.

To open the account, y'all will demand to use your smartphone's camera to have a photo and send an paradigm of an ID document.

This document can exist an ID bill of fare or passport, and it does not affair which country issues it. The application uses advanced technology to confirm your identity, so you can go account details in minutes, including the account number also every bit sort code.

What Types of Accounts Does Monese Offer?

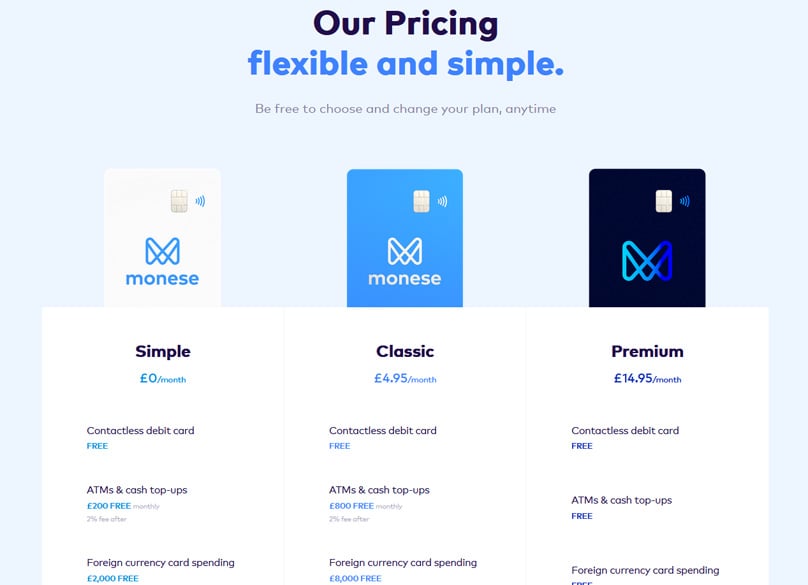

Monese offers 3 account types: Simple, Archetype & Premium.

Regardless of business relationship type, at that place is a maximum balance for the account of £40,000 for Britain-based accounts. It is possible to switch between business relationship types at whatsoever point.

Those opening an business relationship in the Eurozone volition detect a €10,000 maximum remainder for all account types in France and a maximum of €fifty,000 for Plus and Premium accounts in other countries.

Simple accounts are costless (£0 per month), and at that place is no fee for using the contactless debit carte du jour. At that place is a £one fee for ATM cash withdrawals, a two per cent foreign currency exchange fee (minimum of £2), a 0.35 per cent fee for instant peak-ups, a ii per cent fee (£2 minimum) for mail service office cash elevation-ups, and a iii.v per cent fee (£iii minimum) for PayPoint top-ups.

Classic accounts cost £5.95 per calendar month and add together six gratis ATM greenbacks withdrawals per month. This blazon of account lowers strange exchanges fees to 0.five per cent (£2 minimum) and cash top-ups to £1 at the Post Function and two.5 per cent (£1 minimum) for PayPoint.

Premium accounts price £14.95 per calendar month but have no fees, including for currency exchanges and both cash and instant elevation-ups. They also have unlimited ATM greenbacks withdrawals for free.

Unproblematic – £0/month

- Contactless debit card

FREE - ATMs & cash top-ups

£200 FREE monthly

ii% fee subsequently - Foreign currency bill of fare spending

£ii,000 FREE

2% fee later on - Foreign currency transfers

Gratuitous & instant to other Monese accounts two% fee when sending to non-Monese accounts £2 minimum fee

Classic – £5.95/month

- Contactless debit card

Complimentary - ATMs & greenbacks top-ups

£800 FREE monthly

2% fee after - Strange currency card spending

£viii,000 FREE

two% fee later - Foreign currency transfers

FREE & instant to other Monese accounts from 0.5% fee when sending to non-Monese accounts £2 minimum fee

Premium – £fourteen.95/month

- Contactless debit carte du jour

Free - ATMs & greenbacks pinnacle-ups

Gratis - Foreign currency card spending

FREE - Foreign currency transfers

FREE & instant to other Monese accounts Free when sending to non-Monese accounts

Main Features of an Account with Monese

With a Monese account, you can engage in unlimited transactions, receive euros or pounds via depository financial institution transfers, make apply of fast depository financial institution transfers, make straight debits, get greenbacks at ATMs around the world, and use a contactless debit card.

Monese Fees

There are no subconscious fees associated with opening a Monese business relationship. There is also no minimum balance required.

Traditional banks make their profits by a combination of reinvesting the coin of customers and charging incredibly high fees.

Those fees typically utilize to everything from loftier interest rates for loans and overdrafts to missed straight debits, money transfers, and using the carte overseas. Past contrast, Monese does non charge these excessive fees.

Monese Debit Card

The Monese debit bill of fare functions exactly as you lot look a debit card to piece of work. This is likewise a contactless debit menu for actress convenience.

The Monese debit card is accepted in more than than 200 countries around the globe, likewise as past most mobile app services and major online retailers. Essentially, it is possible to use your Monese debit carte to pay for your daily transactions effectually the globe.

It is likewise of import to note that the Monese debit card acts every bit a prepaid carte du jour. This ways that if you wish, you tin ready a upkeep, and the card volition not permit you overspend or run upward a debt.

The contactless nature of the Monese debit card means that you tin can make transactions in seconds. There is no need to enter the PIN, either, if your transaction is £xxx or less.

There are no security concerns with contactless payments since the merchant will only exist able to take the specific corporeality of the transaction a single fourth dimension.

Contactless payments let you avoid carrying spare change for smaller transactions, save time, and reduce the run a risk of fraud since you lot never take to let your card out of your manus.

Apple Pay

In Feb 2019 Monese made the annunciation that they have added Apple tree Pay for personal Great britain and European Monese cards in the UK and France. This means you can brand payments in person using your iPhone or for iOS apps and around the web where it is accepted.

With a tap on your phone you now have the ability to pay thousands of shops and other merchants.

Apple tree Pay is bachelor in 27 countries.

How Do Y'all Lock Your Monese Card?

If you lot ever suspect that your card has been compromised or do not want to chance spending your money, you can easily and instantly lock the Monese debit card via the application. Unlocking is also unproblematic via the awarding. Once you lock your debit card, you can easily society a new one from Monese.

How Do Y'all Make Deposits to Your Monese Account?

Monese makes it simple to deposit funds into an account using one of several methods. Those who are in the United Kingdom will appreciate that the current accounts include an account number and a sort lawmaking that brand information technology possible to receive Britain bank transfers.

These transfers can be from companies or individuals and include direct payments from employers.

Those who are exterior of the United Kingdom can make payments into a U.k. Monese account using European IBAN.

To complete this type of deposit, you just brand a bank transfer into Monese's European IBAN account with the payment reference of your Monese ID.

Monese will so use the existent exchange rate for the currency conversion, so you become the all-time substitution rate possible. From there, Monese will route the funds into your U.k. Monese business relationship in the form of GBP.

In addition to the ability to deposit funds into a Monese account via UK or European transfers, it is possible to top upwards greenbacks at i of the more than than twoscore,000 locations in the UK.

Monese partnered with PayPoint and the Post Function, and so clients can go anywhere with the PayPoint logo and instantly pinnacle up greenbacks in their Monese business relationship.

This ways that you can visit any off-license, corner shop, or high-street convenience shop with the PayPoint logo or go to your user-friendly Post Office.

If you choose to top up with cash at the Post Office, but give the cash to the cashier. You volition then insert your Monese debit card into the card reader, and the money will arrive in your Monese account the post-obit business concern mean solar day.

For PayPoint transactions, you but ask to employ PayPoint at the counter and give the cashier your Monese card too every bit your cash.

Withdrawal Fees from Monese

Opting for a Monese Plus account gives y'all six free withdrawals from ATMs each month, so you tin can easily and freely get additional access to greenbacks. You can employ the debit carte du jour at whatever ATM which accepts MasterCard. Most ATMs volition exist complimentary to use unless explicitly stated otherwise.

How Can Yous Make Payments with Monese?

You lot can utilise your Monese debit carte to make payments merely like you would with whatsoever other MasterCard.

It is also possible to make payments via your mobile application. In only a few taps, yous can pay utility bills, hire, or for goods and services.

You besides can pay an private or company via a banking concern transfer. Any payment between Monese accounts volition be gratis and occur in existent-time, without any limit on the number of transfers you can make.

You lot tin can besides make regular banking company transfers to accounts from other banks. It is also possible to sign up for Straight Debits with Monese accounts, perfect for ensuring bills are accurate and and then paying them.

With Monese, it is as well possible to transfer money internationally in your choice of viii different currencies.

Best of all, the fees are equally much as 8 times less than what you lot would pay if you used a banking company. Monese can offering incredibly low rates because the company processes transactions worth millions of pounds daily, letting the company purchase currency using wholesale rates, which it then passes onto clients.

International Money Transfers with Monese

Monese makes it possible for clients to convert their funds using the interbank rate for quick international coin transfers at very low costs.

The fact that Monese charges clients the aforementioned wholesale commutation charge per unit used by banks means that customers salvage as much equally 88 per cent when they transport money away using the application.

With Monese, yous tin send coin to Belgium, Bulgaria, Austria, Cyprus, the Czech Republic, Republic of estonia, Finland, France, Kingdom of denmark, Federal republic of germany, Greece, Republic of ireland, Italy, Hungary, Lithuania, Luxembourg, Republic of latvia, Norway, the Netherlands, Malta, Portugal, Romania, Poland, Slovenia, Kingdom of spain, Slovakia, Sweden, or the Us via a transfer. In terms of currencies, y'all can transport GBP into i of several currencies, including BGN, CZK, DKK, EUR, HUF, NOK, PLN, RON, SEK, or USD.

Help with Budgeting

With Monese, account holders can utilize some features to help with budgeting. There is 24/7 access to your business relationship via the awarding, then you can always keep an eye on your account.

At that place is also a user-friendly "Instabalance" feature that displays a real-fourth dimension view of the remainder of your business relationship right in your smartphone's notifications tray. This lets you know at a glance how much you can spend.

Within the application, you volition observe a balance graph for a visual representation of how yous spend money. This tin assistance clients track spending goals and analyse the times of the month when they are probable to spend more than or besides much.

Additionally, Monese does not follow the format of other banks that let you spend more than your balance and then charge you lot high fees via penalties.

Instead, Monese only lets you spend the amount that you lot already have in your account. This helps encourage salubrious spending and budgeting and delivers peace of mind that you volition non accrue overdraft fees.

What Types of Notifications Does Monese Provide?

Monese provides you with notifications for sure actions, both as a convenience and as a security measure. Every time you spend money with your Monese bill of fare, elevation upward coin, or receive a payment, you receive a notification.

Monese & Avios Partnership

Merely recently announced is a new partnership between Monese and Avios. Avios is a reward points currency for British Airways Executive Guild, Iberia Plus, AerClub, Vueling Club and Meridiana Lodge. Millions of customers collect Avios in over 190 countries globe-wide.

Monese is the earth's outset current account linked with Avios and it offers a new, seamless fiscal and lifestyle direction service.

Sitting within the Monese app, Avios appears as a separate account, alongside other Monese currency accounts such as euros and pounds. This allows customers to rails and maximise their Avios as they fly, travel, or spend across hundreds of Avios partner brands such as ASOS, John Lewis and Merely Swallow.

Customers will soon also be able to earn Avios points by paying with their Monese card and for referring friends. They volition also be able to ship and receive Avios between Monese customers.

Monese Security

As mentioned earlier, Monese lets y'all hands lock and unlock your debit card via the application. This is a great security characteristic that can assist foreclose unauthorised spending if y'all lose your debit card or it is stolen.

Monese as well takes a more than secure arroyo to your Pivot. You lot do not demand to write it down anywhere or expect to receive a written PIN in the mail. To proceed your PIN safe, yous instead view it right in the Monese application.

To view it, just securely log into the application and enter your card's CVV number. From at that place, yous can instantly see the PIN. This not only ensures no one volition find a paper with your PIN written down or intercept it in the mail but likewise means that if yous lose your PIN, you can easily find it in a secure yet elementary-to-admission location.

Monese besides makes the security of both personal information and coin a priority. Monese uses breakthrough processes and technologies to protect accounts from unauthorised admission.

For added security, information technology is only possible to access Monese from a single mobile device. This means that information technology is impossible for anyone to go control of your account while in another location.

When y'all want to access your account through a new device, you will starting time need to manually authorise it via a multi-factor authentication process for enhanced security.

If your phone gets stolen, the thief will not be able to enter your Monese application since y'all must enter a secure v-digit passcode that simply you know to admission the app.

Additionally, Monese has around-the-clock monitoring via avant-garde banking infrastructure. This monitoring takes place 24 hours a day and vii days a week.

There is as well protection of the funds in your Monese business relationship due to the bank's authorisation by the FCA and its registration. While banks typically reinvest customer funds, Monese does not do this. Additionally, Monese keeps all client funds separate to ensure that all customers would be able to receive their full remainder in the unlikely event that Monese can no longer be in business.

Determination

Monese is a bank account for those living in the Eurozone and the UK that is only bachelor via a mobile app.

This bank account has competitive fees and is designed to have nearly guaranteed approval, making it possible for those without utility bills, proof of address, or a UK credit history to open a bank account.

Monese is a cracking pick for people who need bones banking with the choice of a debit card, the mobile app is well designed and easy to use.

All the same, it does lack some features of a full banking company account such as an overdraft option and paying interest on savings.

If you lot need admission to a basic bank business relationship which is easy to setup via the mobile app then nosotros practise recommend you take a look at Monese.

Visit Monese or Become Monese App (Android or iOS)

Monese

Pros

- Fast & Unproblematic Setup

- No Fees for Money Transfers

- Debit Card Selection

- Good Currency Exchange Rates

- UK & Euro Accounts

Cons

- Fees for PayPoint and post part deposits

- Accuse for Withdrawals after 6 Free

xv,288

Source: https://moneycheck.com/monese-review/

Post a Comment for "Blank Atm Card Post Comment and Review @facebookcom"